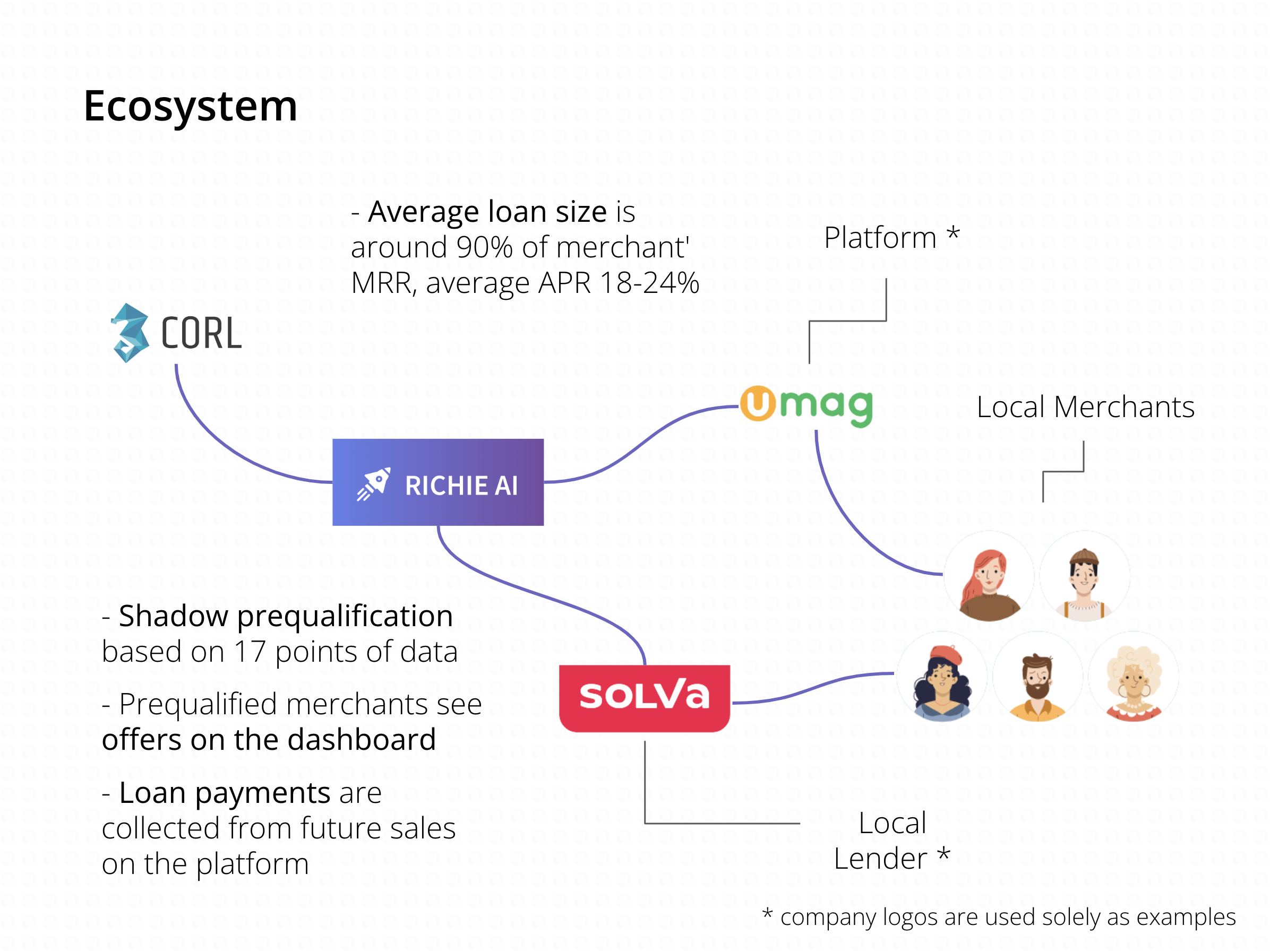

Unified Lending Infrastructure

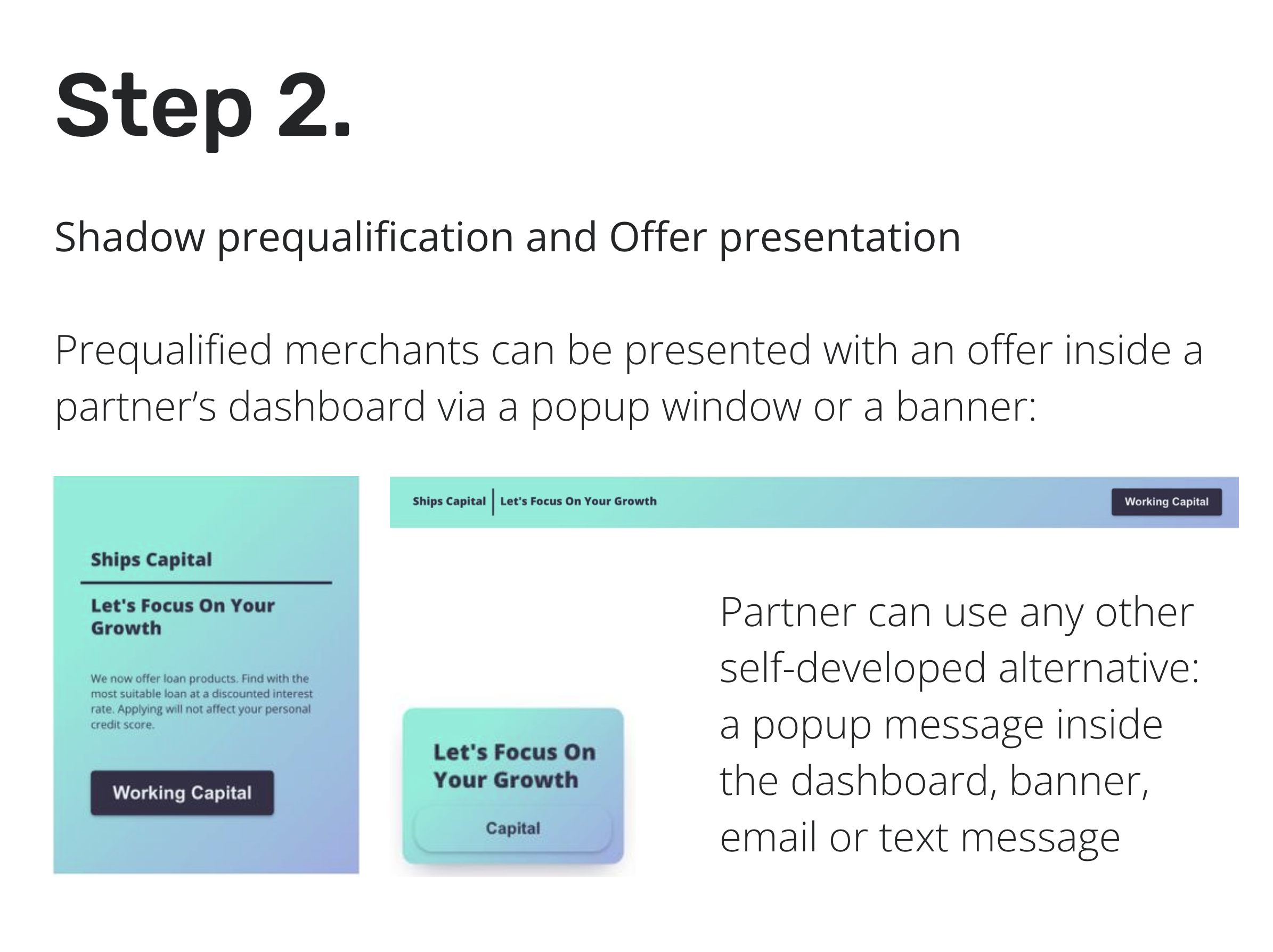

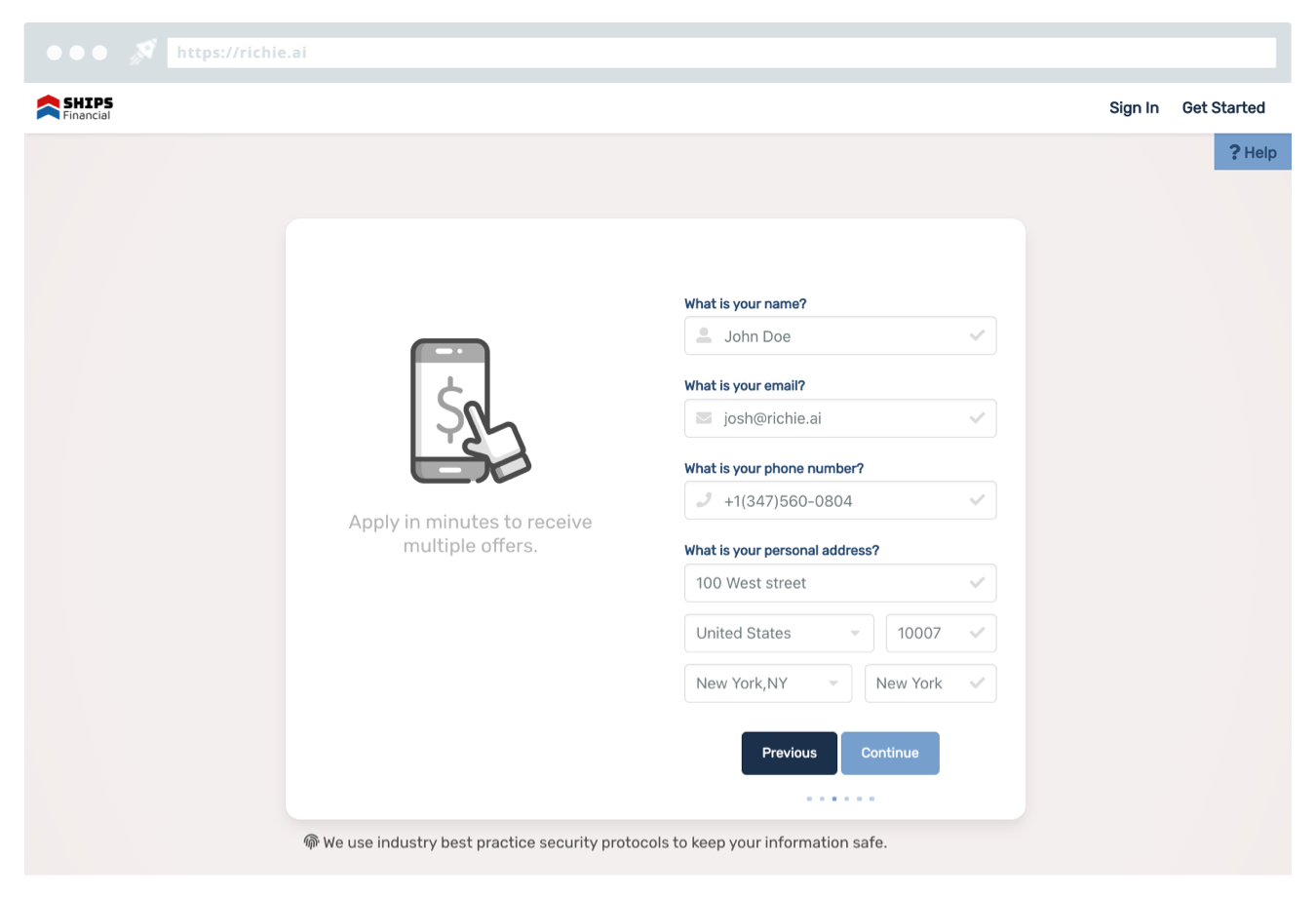

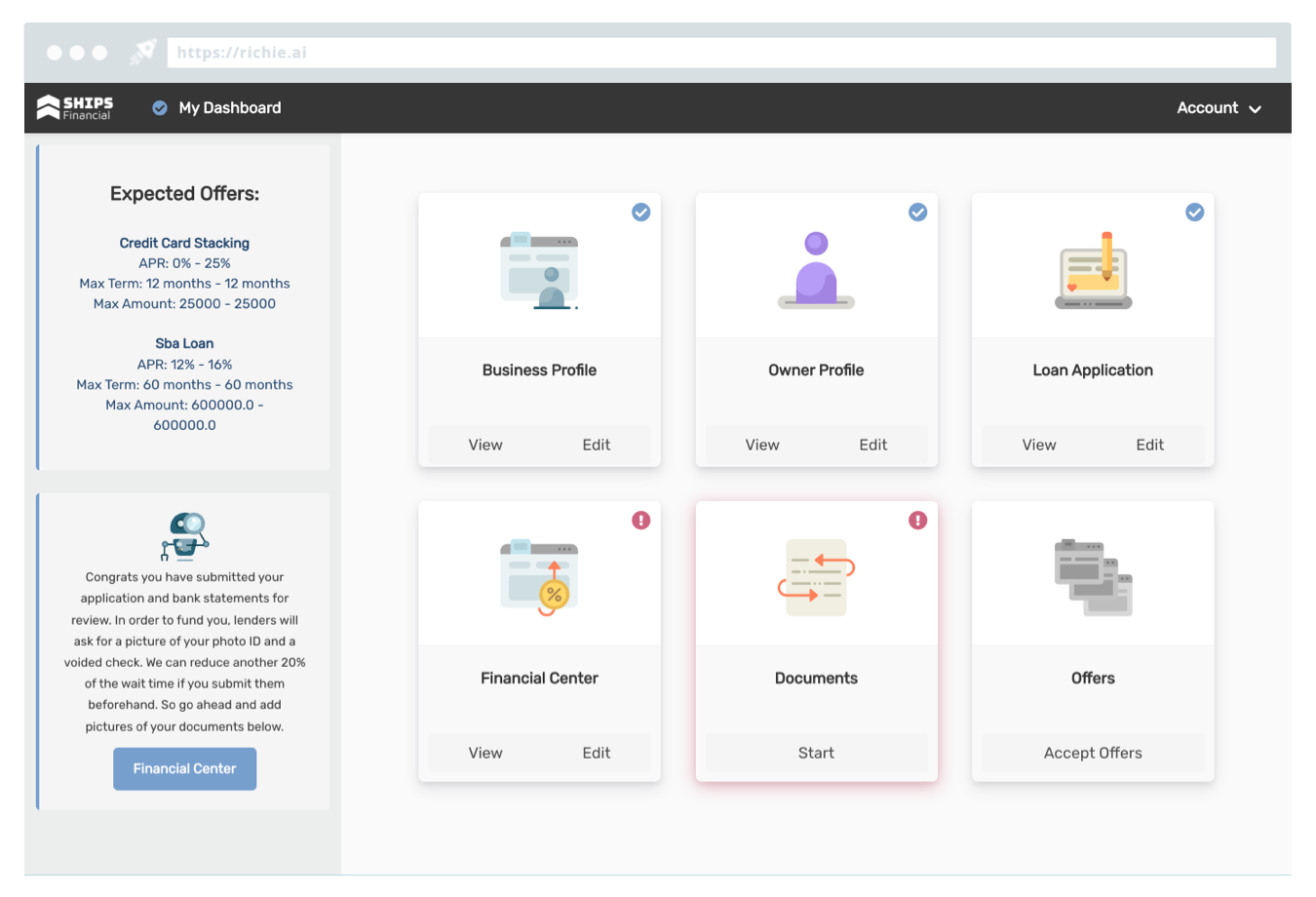

Richie AI provides a unified lending infrastructure that enables B2B companies to offer a comprehensive suite of business loan products to their customers. Our technology is designed to streamline the lending process, from prequalification to loan application and management, while ensuring compliance and providing access to capital.